BENEFITS

Strength

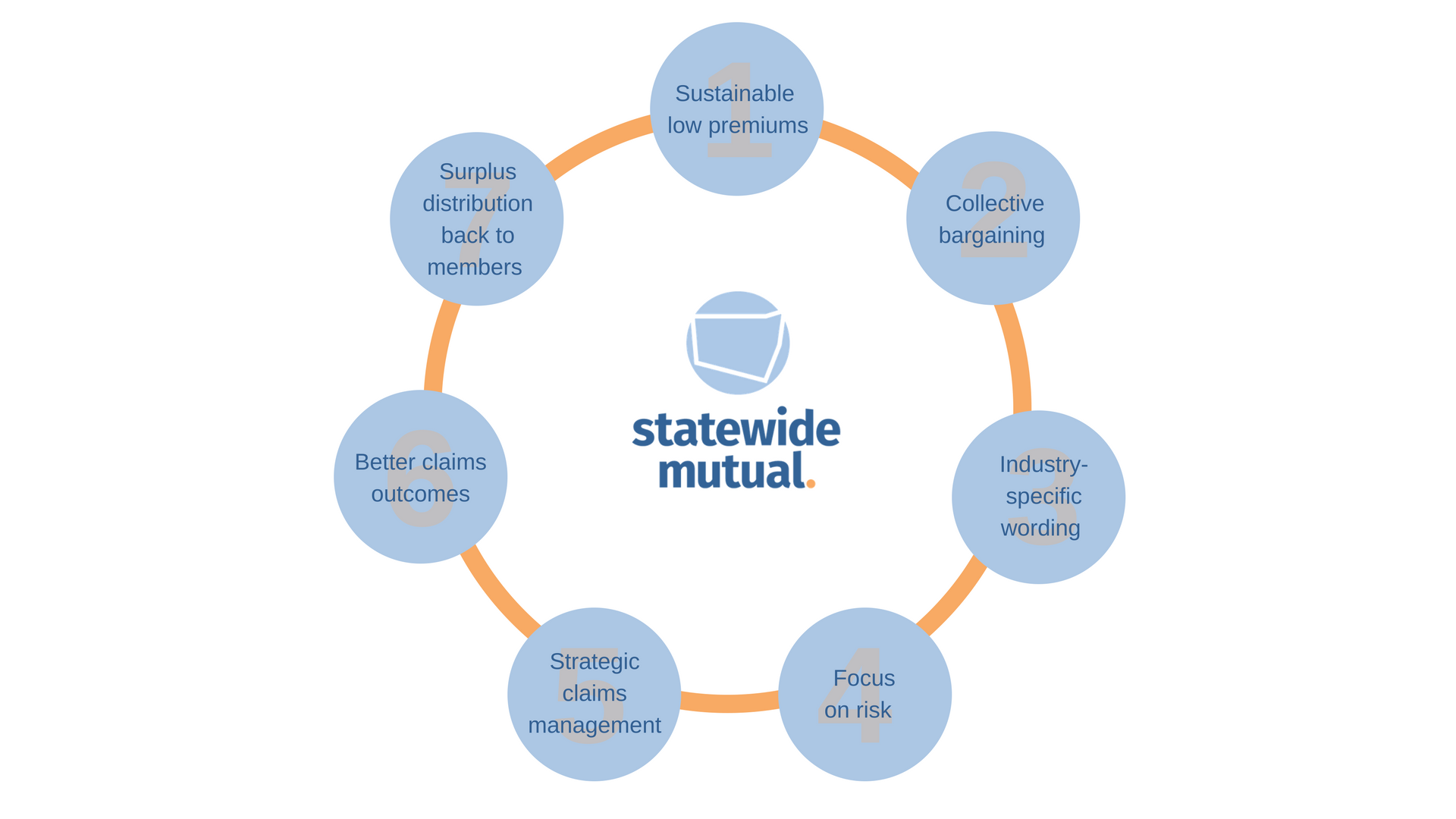

As Australia’s largest local government self-insurance pool, we deliver substantial benefits to Members. Our considerable buying power permits negotiation of market-leading, long-term reinsurance treaties with underwriters. High coverage limits for comprehensive protection with sustainably low Member contributions are a given.

Our sheer size makes it possible to dictate bespoke wordings for policy agreements. Rather than underwriters determining our conditions, we insist on individual scheme inclusions based on our membership’s collective needs.

The strength of the mutual and its ability to spread risk safeguards individual members against financial disaster. Impacts of multi-million dollar claims are absorbed when spread among our 113 members.

Stability

Members gain from our extensive experience and proven track record of stability. We have a solid 24-year history while other providers have come and gone.

Having a stable risk partner with an enviable level of Local Government expertise means Members have access to a ‘whole of risk solution’ covering placement of insurance, risk management programs and claims administration.

The ability for Members to contain costs and build equity highlights the effectiveness of this solution. Sound risk management practices and superior claims handling allow the payment of substantial rebates.

Integrity

Statewide Mutual is owned by Members, governed by a Board – comprised of elected Member Council representatives – and managed by JLT Risk Solutions.

In the absence of shareholders, the Board goes to great lengths to ensure the mutual acts solely in the interest of members. They keep a close eye on the numbers to ensure financial viability, including maintaining an appropriate solvency margin. All governance activity and decisions are made readily available to all.